Parts of a Mortgage Application

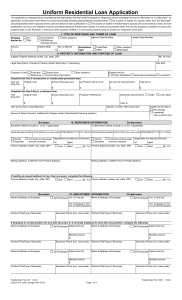

The mortgage application, also known as the 1003 or the uniform residential loan application, is the primary form used to gather information to judge your ability to get a mortgage. It is 5 pages long, and can be intimidating to a lot of borrowers (especially first time home buyers). Today, I’d like to break this document down a little bit and discuss the parts of the mortgage application.

The mortgage application, also known as the 1003 or the uniform residential loan application, is the primary form used to gather information to judge your ability to get a mortgage. It is 5 pages long, and can be intimidating to a lot of borrowers (especially first time home buyers). Today, I’d like to break this document down a little bit and discuss the parts of the mortgage application.

The first section, section I, is information you will get from your loan officer, so you can skip right over it to section II. Section II covers basic information about the property (address, property type, year built, title of house, etc.). This should be filled out to the best of your knowledge based upon the information given to you by the realtor.

Section III focuses on you, the borrower. It is split down the middle, with the left side covering the primary borrower and the right side covering the co-borrower (if applicable). This section simply asks for names, social security numbers, dates of birth, etc. about the applicants. Section IV, similarly, is about you. This section just asks basic employment questions for your employers over the last 2 years.

Section V covers monthly income and housing expenses. This section has 4 columns to fill out; on the left you will fill out all of the income information for the borrower and co-borrower. This includes income from employment, dividends, rentals, etc. The right side is the expenses, and the first column is your current payments, and the second is for the new mortgage. Section V leads right into section VI, which covers assets and liabilities. This is where you can list other properties you own (i.e. rental or second homes), as well as any bank accounts, investments, or retirement accounts. Next to that, you will list all of your outstanding debts (credit cards, mortgages, loans, etc.).

In section VII, you will fill out all of the information about the mortgage. This is another section you will need to consult your mortgage officer for. It asks for the specific breakdown of the purchase price, loan amount, mortgage insurance, closing costs, seller’s concession, etc. Section VIII just asks a series of questions to be answered by the borrower and co-borrower separately. Just answer them honestly and don’t get too hung up on them.

And the last section, section IX, is where the fine print is and you sign. And that’s it, you’ve completed your 1003 and are ready to officially apply for your mortgage and lock in your rate.

If you are in the market for a new house and have any questions about the mortgage process, please contact me. And if you have anything else to add, or if you have any other questions about the 1003, please leave a comment.

Submit a comment