Calculating Personal Income From a C-Corp

Last week, I explained how to calculate personal income from business entities which are filed through your personal tax returns, namely the Sole Proprietorship and the LLC. This week, I have decided to tackle the more complicated corporate structures. I started the week with the S-Corp, which is most like the other 2 structures, and today will explain how you can determine how much of your C-Corp income can be used toward buying a home.

Last week, I explained how to calculate personal income from business entities which are filed through your personal tax returns, namely the Sole Proprietorship and the LLC. This week, I have decided to tackle the more complicated corporate structures. I started the week with the S-Corp, which is most like the other 2 structures, and today will explain how you can determine how much of your C-Corp income can be used toward buying a home.

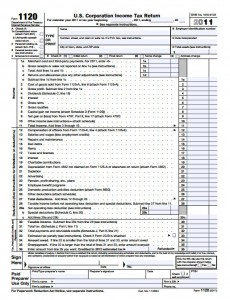

The C-Corp, like the S-Corp, requires a separate tax filing, as it is a completely separate taxable entity. This filing is done through a corporate tax return on Form 1120. But unlike the S-Corp, the income of the business is taxable both at the corporate and personal level.

Form 1120 is where you can calculate your business gross and net profits, deductions, and how much you must pay in taxes. After calculating your net profits and deducting taxes, whatever remains may either be paid to the owners of the business or remain in the business for future use. So unlike the other business entities, the profits of the business are not necessarily personal income, and as such are not necessarily used to calculate how much house you can afford.

Instead, you need to figure out how much you paid yourself in W-2 salary and wages throughout the year, and add to it any portion of dividends paid by the business. The dividends are the distribution of business profit by the corporation to the shareholders, or owners. So if you decide to take half of the profit from your business as income, you would call that a dividend, and that would be usable income for getting a mortgage.

If you need any help in determining how much you earned in income which can be used for a mortgage, please contact me. And if you have anything to add about calculating personal income from a C-Corp, please leave a comment.

Submit a comment