First Time Home Buyers in Michigan – 4 Thing to Know About Credits

Buying a home is rarely a quick process. Going through writing multiple offers, coming up against  sellers who refuse to budge on price, the pre-approval process, drawn-out short sales and more can all be time consuming. Once you finally secure that mortgage in Michigan, locate the perfect home and work through all the negotiations, you finally hit a point where you strike a deal with a seller.

sellers who refuse to budge on price, the pre-approval process, drawn-out short sales and more can all be time consuming. Once you finally secure that mortgage in Michigan, locate the perfect home and work through all the negotiations, you finally hit a point where you strike a deal with a seller.

But how solid is that deal?

Getting a signature on the sale contract and sliding money into escrow is, unfortunately, just the beginning of additional negotiations. In most cases, there tends to be last minute credits that come up. If you’re getting ready to buy a home in southeast Michigan to move to a more comfortable community like Royal Oak or Novi, then here are some things you should know about last-minute credits.

1. Ask for Credits Based on Property Inspections

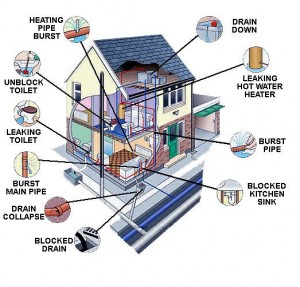

A typical real estate contract takes property inspections into consideration. This allows for an out if there are damages and repairs that can be too costly, or problems that significantly impact the value of the home. Other things that turn up in an inspection can, including home inspection, pools, sewer lines, termites, etc, can have an impact on the final price.

Having these inspections can bring up things the buyer had no idea existed before the contract was signed. If the buyer is still interested, that’s where a credit comes into play. Per most lenders, credits for some issues found during general inspections can be up to around 3%. Negotiations usually wind up with the buyer and seller making a few bids and then averaging out those bids.

2. Avoiding Credits by Getting Work Done Before Escrow

There are some occasions where a seller may not want to give a credit and will want to get the work done before the close of escrow. This is often because the seller doesn’t want to lose extra into a credit, especially if the new owner never actually has the work done. Getting the work done before escrow closes can often protect the seller, because the actual work may cost significantly less than estimates given.

3. Be Fair on Negotiations

Everyone has their own moral compass and they don’t all point the same way. There are some buyers who seek out inspections and credits just to get the price down, but a buyer always runs the risk of losing out if they go down this road.

Sometimes a buyer believes that after the long negotiations, the contract, the loan approval and inspection completion that they’re empowered – and the seller won’t want to waste all that time. So they push for a credit, because they don’t think the seller will go back to “start” over a few more dollars.

A strong buyer’s market, like we’re experiencing now, provides a fair chance that a buyer could pull this off but – if you’ve found an amazing deal on a home would you really be willing to risk your find over a few thousand dollars? Using property inspections to drop the price is risky, and then there’s the whole “karmic retribution”. Imagine down the road trying to get that house sold, and a buyer tries to work the same system.

4. Expect a Cushion

A seller that has done their research knows buyers almost always ask for credits when buying a home, whether that’s a new home in the Metro-Detroit area or in San Diego, CA. When they expect that buyers will ask for credits or minor repair work, those costs are typically worked into the asking price on the home and are part of negotiations before a buyer even asks.

With that in mind, a buyer should never be afraid of asking for a credit or repair work when it’s appropriate.

Submit a comment