Buying a Foreclosure in Michigan – Top Foreclosure Myths

Myth #1: Foreclosed Homes Are Always In Bad Neighborhoods

There really isn’t any point in history where this has been true. While the “bad” neighborhoods, or those in depressed economic areas, may show significant amounts of foreclosures, they do not represent the bulk of the foreclosures around the U.S.

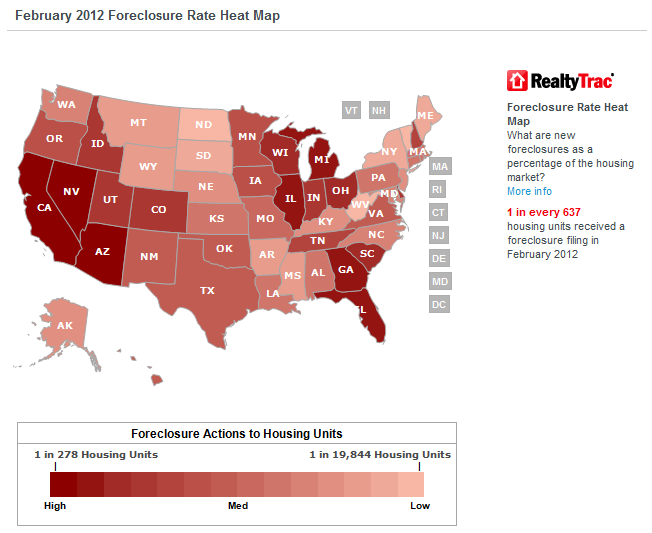

In the current economic climate, every state and every community or town can and likely does contain a high number of foreclosed properties. In fact, a recent study by RealtyTrac shows that foreclosures are widespread – in every state – and in virtually every community. See the following map from RealtyTrac to see the spread of foreclosures across the U.S.

The homes that are reclaimed under foreclosure range from simple town homes and family homes within small towns to major vacation homes in expensive hotspot communities from coast to coast.

It’s a poor assumption to believe that foreclosure signifies a bad area. Most families are touched by the recession, some more than others. If a certain area has a high amount of foreclosure, the lack of people present could give the area a more depressed and rundown appearance but even that is judging a book by its cover.

The best course of action is to review the demographics and statistics for a given area if you’re interested in buying a foreclosed home.

Myth #2: Michigan Foreclosures are in Poor Condition

Far too many first time buyers in Michigan believe that foreclosed homes are nothing but a disaster that is falling apart, in need of a great deal of work to become livable and pass inspection.

This typically isn’t the case.

It’s possible that there could be some structural or cosmetic issues, but even a regular home on the market could have the same issues on closer inspection. Don’t approach foreclosures expecting a serious fixer-upper. There are plenty of homes in perfectly livable condition.

As a buyer, you should do your research before buying a home or getting a mortgage in Michigan, including a foreclosed home. That research should include what type of maintenance was done before the home hit the market, how long it has been sitting idle, the updates that were made while it was occupied, etc.

There are some instances where a previous owner under foreclosure did damage to a home before vacating it, or removed vital components. This is where your research and inspection comes in to play, and it’s up to you whether or not you want to buy the home and make the additional investment to repair what damage was done – as most homes under foreclosure sell “as is”.

Myth #3: Foreclosed Homes Sell At Massive Discounts

It’s a common misconception that foreclosures always sell at significant discounts because the bank just wants to make their money back on the property. This branches from a few trains of thought.

- A homeowner has paid a lot in and then couldn’t pay anymore, so less it owed on the house – thus, it won’t cost as much to buy it.

- Banks really want to offload a foreclosed property so they’re willing to take whatever they can get

- Foreclosed homes have a lot wrong with them (see myth #3) so I can haggle the price down even more

More than a third of first time buyers in Michigan typically expect to get as much as 50% discount off the value of the property when they buy a foreclosure. While a foreclosure may indeed be discounted in comparison to surrounding properties, those discounted prices are often modest in comparison to the value of the actual home.

It’s not impossible to get a home at a significantly reduce price, they’re out there. If that’s your focus however you’ll spend a great deal of time viewing foreclosures in the Metro-Detroit area and surrounding communities before you find a low enough price on a home that still offers all the amenities you’re looking for.

Myth #4: A Spike In Foreclosures Is Around The Corner

If you’ve been waiting for some of those upscale Royal Oak and Birmingham McMansions to start showing up under bank listings or at the auction block, you may be waiting for a while.

There are still plenty of homeowners that took short-term adjustable rate loans or home-equity lines of credit who are grappling with making their mortgage payments, but despite that, the foreclosure rate isn’t going to suddenly sky rocket.

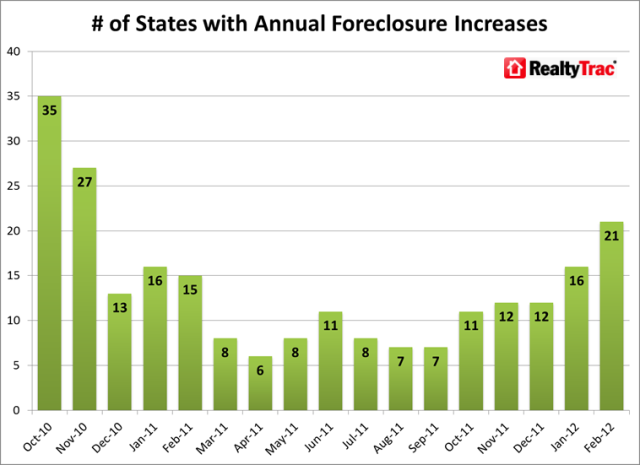

It’s changed a bit in recent months during the first quarter of 2012, and according to RealtyTrac the # of states with annual foreclosures are increasing – but that’s widespread across the United States. That doesn’t mean Michigan and Metro-Detroit is going to see a foreclosure boom.

In addition, a $26 billion settlement penalizing the nations 5 largest banks (Bank of America, JPMorgan Chase, Citigroup, Wells Fargo and Ally Financial) is requiring them to slash the principals for existing mortgage borrowers due to the lenders’ role in the foreclosure processing scandals uncovered in 2010, where it was revealed that the top 5 lenders were knowingly pushing through thousands of foreclosures without proper documentation.

Bank of America will soon be reducing home loan balances for 200,000 of its customers. With these 5 lenders all taking the same approach, plenty of borrowers will find some relief over the next 12 months.

So what does that mean for you?

Stop waiting for a break to suddenly appear in the current market in the hopes of finding the perfect deal. If you’re seriously considering buying a home in Michigan or around the Metro-Detroit area, then avoid making decisions based on myths. Foreclosures are a great way to buy a first home, but you’re going to come out of the deal with money hanging out of your pockets.

Don’t miss out on great properties and opportunities to buy the ideal starter house because you’re waiting for the cheapest foreclosure. Get your mortgage pre-approval and start looking at all of your options today.

Submit a comment