Mortgages in Michigan – Buying into the Endangered Foreclosure

If you’re thinking about obtaining a mortgage in Michigan, now is probably the best time to make a move. The demand for foreclosures in Michigan continues to remain high but the number of available foreclosures – particularly those that are attractive to first time buyers – are steadily dwindling.

Bank Repossessions are Down Last Quarter of 2011

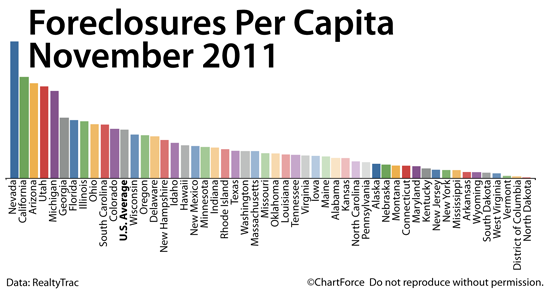

According to tracking and information available from firm RealtyTrac, the number of foreclosure filings feel 3% as the market entered the last quarter of 2011. Those numbers were down 14% from November of 2010.

Of course “foreclosure filing” embodies a lot of different actions in the process. This comprises of defaults and subsequent notices, home auctions, and ultimately repossession from a lender. If you’re a home buyer, monthly bank repossessions are an important statistic to watch. It’s a gauge of “supply” in the real estate market. The number of new foreclosures entering the market hasn’t been this low since the first quarter of 2008.

Finding Foreclosures – Michigan is still Holding Up

If you were to break down the foreclosures by state, including Michigan, you would see that 56% bank repossessions were located in just 6 states

California: 14.8% of all bank REO

Florida: 12.7% of all bank REO

Texas: 7% of all bank REO

Georgia: 6.9% of all bank REO

Arizona: 6.7% of all bank REO

Michigan: 6.3% of all bank REO

If you look at these figures, you can see that first time buyers within these regions would have a lot more luck finding foreclosed properties or homes on short-sale than in other locations throughout the United States. For example, South Dakota topped the chart (or bottomed it out) with the fewest foreclosures last November – with just .009% of nationwide foreclosure counts. That translated to 5 foreclosures state wide.

So why is now the time to talk to a mortgage banker in Michigan about a foreclosure? The plunge in bank-owned homes comes at a tough time for home buyers. It’s not getting any easy to acquire mortgages for first time buyers, and the demand remains high for these types of distressed properties. As mortgage rates climb, and the supply dwindles, you can expect the usual discounts of foreclosed homes to shrink, closing the gap and bringing them closer to market value.

Submit a comment